Global appetite for energy is enormous. Its demand is only expected to grow and rightly so. Energy is a critical enabler of prosperity and economic growth, and is essential to sustain and nurture modern society. Yet 67% of anthropogenic CO2 emissions come from energy production, transport and consumption, as we still rely heavily on the fossil-fuel industry. Spurred by rising temperatures, insights into long-term risks of climate crisis and societal push for sustainability, governments, businesses and investors are now investing in energy transition as the path to net-zero. This refers to a total structural transformation of the global energy sector from fossil-based systems dependant on oil, gas and coal to renewable energy sources including solar, wind, hydrogen fuels to name a few.

Resilient Renewables

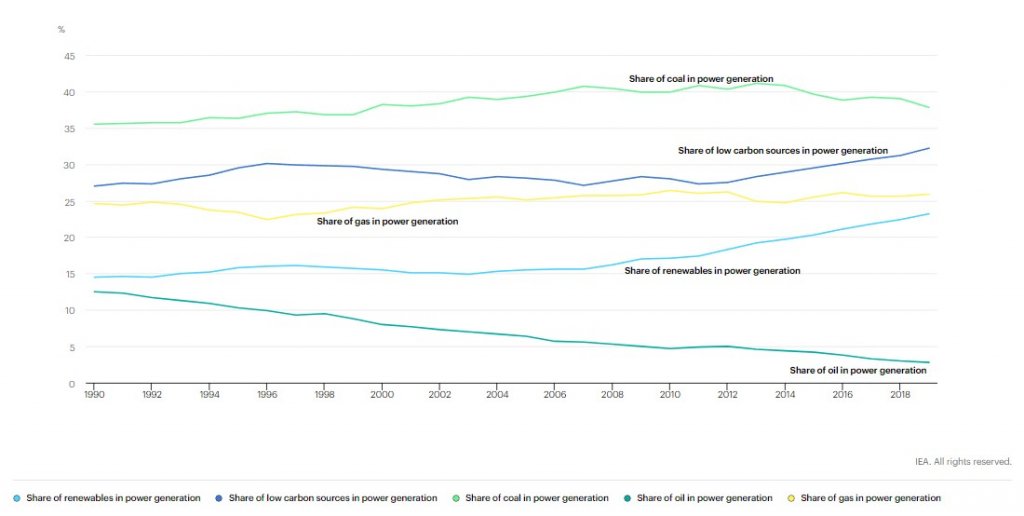

Whether used as fuel sources, in technologies for extraction and conversion, or in end-use sectors such as heating and mobility, renewables auction volumes are breaking records. Steady rise in green policies, financial support and most importantly, technological advancements have steadily made renewables scalable and cost-competitive since the 1990’s. As of 2020, renewables energy sources accounted for a total of 29% of total energy production, a historic achievement.

Reality of the Decarbonisation Shift

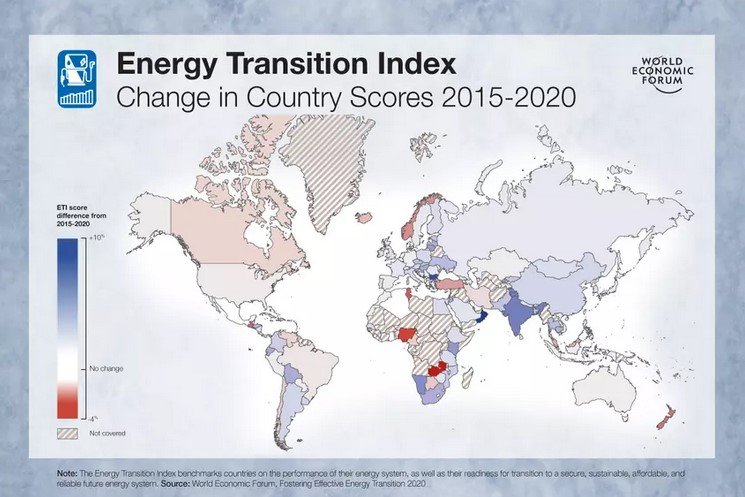

According to the annual Energy Transition Index (ETI), a composite score of 40 indicators that benchmarks 115 countries on the current performance of their energy system and their readiness for transition to a future energy system, 94 countries have improved their scores since 2015.

Representing almost 55% of global emissions, the top 4 emmitters (China, US, Brazil, India and EU28) have directed significant investements in bolstering the renewable power industries. The People’s Republic of China (hereafter, “China”) has pledged to meet 90% of their energy needs through renewables by 2060. Beijing continually dominates the market share of renewable deployment, accounting for 46% of worldwide renewable capacity additions in 2021.

Outside of China, the European Union was the second largest market in terms of increased capacity, with the region surpassing for the first time the all-time-record in 2011. Solar photovoltaics (PV) alone accounted for the majority of the European Union’s expansion last year due to project acceleration in Spain, France, Poland and Germany, driven by a combination of government-led auctions and distributed solar PV incentives.

Despite downward forecast revisions in the United States and the backdrop of the global energy crisis, there is strong policy support in China, EU states, India and Latin America. As the gap between countries in the top quartile, and the rest of the countries narrows, both energy investment and renewable capacity additions are set to pick up by 8% in 2021, showcasing the emerging global consensus on prioritising energy transition, as well as increased sharing of best practices.

Need for an Inclusive Global Energy Transition

An alarming cause of concern remains the omission of several African countries from the ETI map, as well as the low scores of the ones assessed. The momentum of today’s policy and investment plans is not yet enough to meet the energy needs of Africa’s population, thus revealing the stark, unevenness of global energy transition. Africa currently accounts for just 4% of global power supply investments. Achieving reliable electricity supply for African countries would require an almost fourfold increase, around $120 billion a year through 2040.

As CEO & Special Representative of the UN Secretary-General for Sustainable Energy for All, Damilola Ogunbiyi has suggested, “We cannot get to net-zero unless we also address energy poverty. This requires bold commitments from all stakeholders with a key focus on sufficient finance for implementing and ensuring a just and equitable energy transition for all.”

We cannot get to net-zero unless we also address energy poverty.

Damilola Ogunbiyi, CEO & Special Representative of the UN Secretary-General for Sustainable Energy for AllThe path ahead

Invest in energy, lower the premium

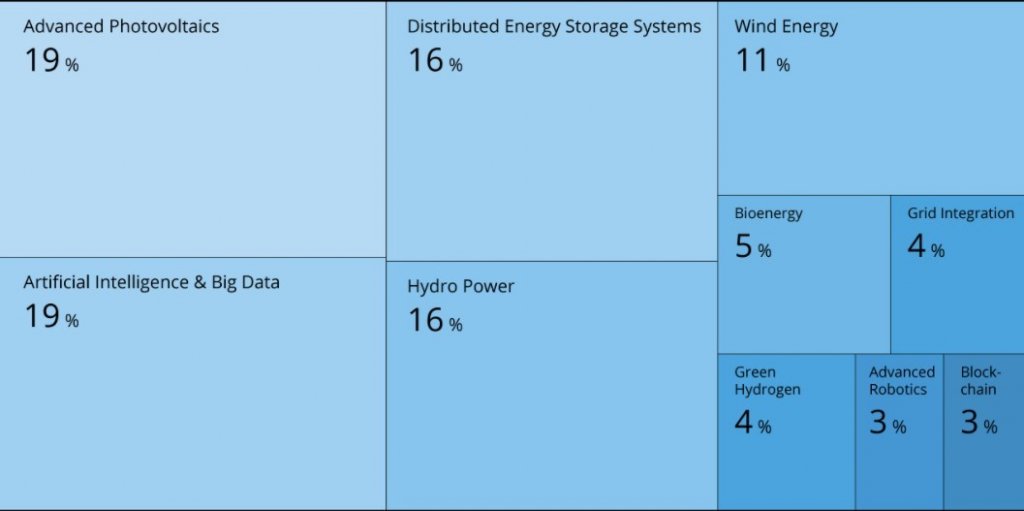

For the first time, the IPCC Report’s 6th Assesment has dedicated entire chapters to innovation and technology. The report draws clear ties between the role of innovative energy solutions, asserting that technological transformation is central to sustainable development and offers multiple entry points to climate mitigation.

As Ann Metler resoundingly said during the Berlin Energy Transition Dialogue 2021, “About half the emissions cuts we need to reach net-zero by 2050 will have to come from breakthrough technologies that are not yet commercialised. The bigger the green premium, that is the cost difference between clean solutions and the incumbent fossil fuels alternative, the harder it makes to transition. The goal then should be to dramatically decrease the green premium by helping bring technologies to scale.”

Strengthening Clean Energy Competitiveness

In spite of increasing price volatility of raw material sources for renewable energies, bottlenecks in rolling out projects due to Covid-19, exciting technological innovations increasingly play a pivotal role in making the market for renewables competitive. The cost of solar and wind, plus storage batteries has decreased up to 85% since 1990s, making them more cost-effective than gas and coal. One of the best examples is the case of Jordan. In only four years, competition has delivered an 85% reduction in renewable energy costs, making it cheaper even than simply burning gas.

Although the industry is still at nascent stage, there is an extremely high economic potential to be unlocked through investments in renewable technologies. As CEOs and governments continue to prioritise ESG goals this would in turn continue to lower the green premium. A McKinsey sustainability forecast of the energy market identified 11 high-potential value pools which included that could be worth anywhere from $9 trillion to more than $12 trillion of yearly revenues by 2030. These include transport ($2.3 trillion to $2.7 trillion per year), buildings ($1.3 trillion to $1.8 trillion), and power ($1.0 trillion to $1.5 trillion). In a scenario where renewables replace fossil-based systems in reaching net-zero by 2050, today’s niche sustainable technology could boom into well over $100 trillion dollar industries.

Emissions Outlook

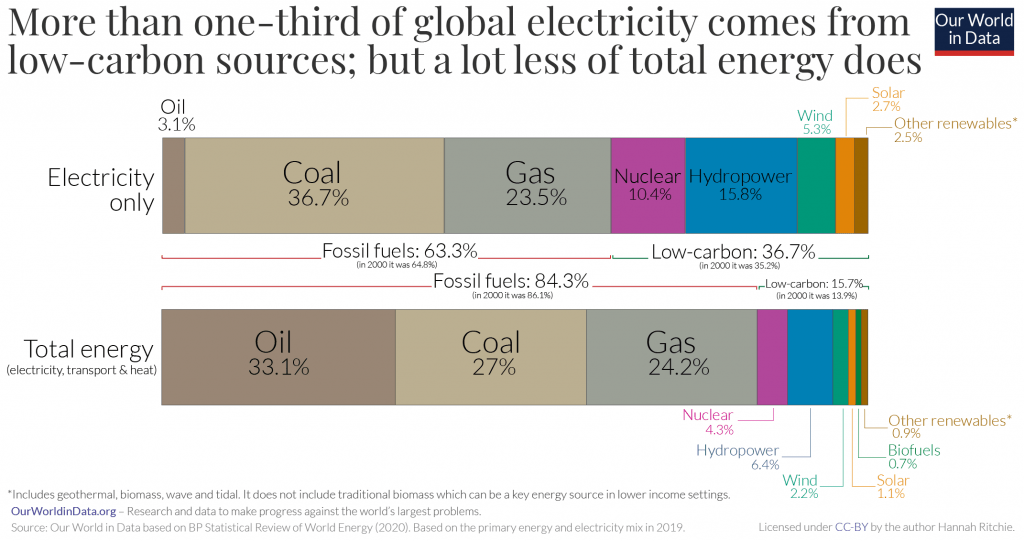

As we globally push towards goals of reaching net-zero by 2050, renewable power deployment as a whole still needs to expand significantly to meet the short-term goal of generating 60% of energy through renewables by 2030. If we achieve this economic output would progressively (and permanently) tilt away from goods and services that are emissions-intensive and toward those that can be made and used without emitting GHGs.

In 2015, 195 countries signed the Paris Agreement, pledging to adapt, mitigate and finance the shift to cutting greenhouse gas emmisions in order to limit global warming to an ambitious 1.5 degree Celsius. If we rely only on climate commitments of the Paris Agreement, temperatures can be expected to rise to 3.2°C. We need to close the ‘commitment’ gap between what we say we will do and what we need to do to prevent dangerous levels of rapid, far-reaching and unprecedented changes in all aspects of society.

As the UNEP Emmissions Gap Report 2019 outlines, today we need to reduce emissions by 7.6% every year, amounting to a five-fold increase in current global commitments. The cuts required are ambitious, but still possible. As of 2021, global average temperature has already increased 1.1°C leaving families, homes and communities devastated. Experts are sounding alarm bells that now might be our “the final call” to keep the target of 1.5°C. Countries cannot wait until they submit their updated Paris pledges and cities, regions, businesses and individuals must all play their part too.

The Great Realocation is Underway

Our challenge based on today’s commitments is to reduce 25 gigatons of emissions by 2030. The development and implementation of advanced technology and efficient renewable energy sources has to be supplemented with a swift move away from our fossil dependant energy system, the share of which still makes up an overwhelming majority of the global energy mix. In advanced economies, coal demand in 2030 is expected to be nearly 45% lower than in 2019. Behind the right policy packages lies the weight of significant financial commitments.

More than 450 institutions belonging to the Glasgow Financial Alliance for Net Zero, which represents more than $130 trillion of financial assets, have promised to align their portfolios with net-zero goals. The European Union has pledged to mobilize €1 trillion in public and private financing to support the European Green Deal. This flow of capital towards enterprises and projects exhibits the strategic and economic significance of global energy transition. A readiness toward a net-zero future is already underway.

Decarbonization will reshape the economy, opening new markets and imperiling others. Investments in energy transition would bring concrete socioeconomic and welfare benefits, adding 85 million jobs worldwide in renewables and other transition-related technologies between today and 2030. These job gains would largely surpass losses of 12 million jobs in fossil fuel industries. Overall, more countries would experience greater benefits on the energy transition path than under business as usual. If oil famously put the world in motion, an effective global energy transition could create value for business and transform society while addressing our planetary health.

Source: deutsche Energie Agentur GmbH